Insurance has always been about protecting people and businesses from risks. But today, the industry is transforming faster than ever. At InsureBrandSuccess, we believe that this rapid change isn’t something to fear—it’s an opportunity. In this new era, insurance agencies need to focus on three big things: agility, innovation, and customer-centricity.

But what do these buzzwords really mean for independent insurance agency owners like you? How can you take advantage of the industry’s evolution to grow your business?

This guide breaks down the complex insights from Deloitte’s 2025 Global Insurance Outlook and translates them into actionable steps you can take to stay ahead. We’ll cover what’s driving changes in the industry and how you can use these trends to your advantage.

What’s Driving Change in the Insurance Industry?

The insurance industry is being impacted by a wide range of factors, from economic shifts to advances in technology and changing customer expectations. To thrive in this environment, insurance agencies need to move quickly, think creatively, and put customers at the center of everything they do. Here are some of the biggest drivers of change:

- Economic Pressures: High inflation has led to increased claims costs, especially in property and casualty (P&C) insurance. To offset these costs, many insurers have raised premiums, leading to “sticker shock” for customers.

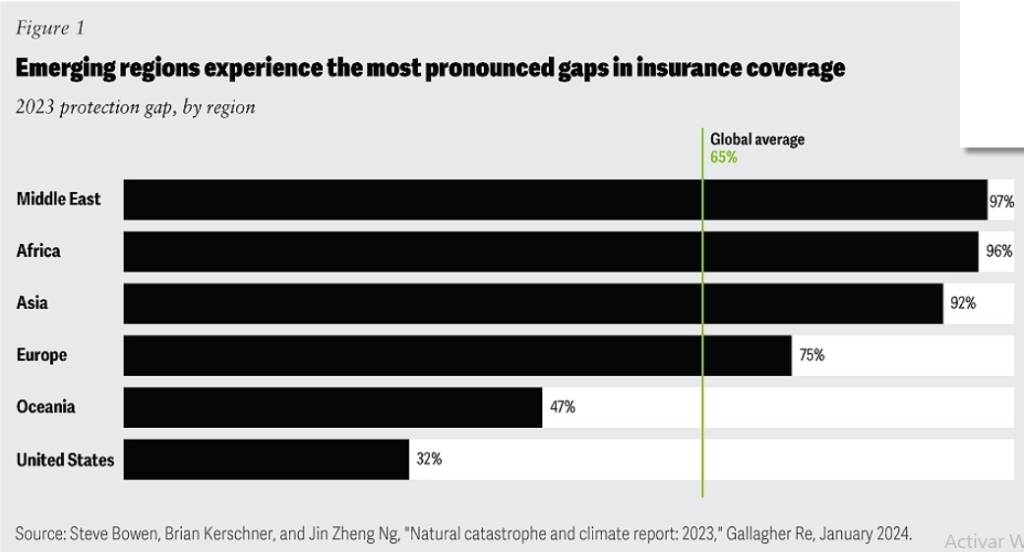

- Climate Change: Natural disasters are becoming more frequent and costly. In 2023, global losses from natural catastrophes reached $357 billion, but only 35% of these losses were insured. This represents a huge protection gap and an opportunity for insurers to offer more comprehensive coverage.

- Technology: The rise of artificial intelligence (AI) and automation is transforming how insurance companies assess risks, process claims, and interact with customers. Customers now expect faster, more personalized service, and agencies that can meet these expectations will have a competitive edge.

- Customer Expectations: Today’s customers are more empowered and tech-savvy than ever. They expect insurance companies to offer easy-to-understand, accessible solutions that fit their needs, and they want these solutions available at their fingertips.

Economic losses from natural catastrophes reached US$357 billion in 2023 globally. Yet only 35% of these losses were insured, leaving a protection gap of 65% or US$234 billion.18 This gap is particularly pronounced in countries in the Middle East, Africa, and Asia (figure 1).

1. Agility: How to Adapt Quickly and Stay Ahead

One of the most important things insurance agencies can do is to become more agile. The days of relying solely on historical data to assess risks are over. Now, agencies need to be able to respond quickly to changing market conditions, whether that means adjusting premiums, adopting new technologies, or offering new products.

Why It Matters:

In 2024, U.S. P&C insurers experienced their best quarter since 2007, driven by quick adjustments to premium rates and a focus on profitability. But while short-term strategies like raising rates can provide immediate relief, long-term success depends on the ability to continuously adapt.

What You Can Do:

- Invest in technology: To be more agile, your agency needs the right tools. Consider adopting AI-based solutions that can help automate processes like claims handling and risk assessment. These technologies not only speed up operations but also allow you to respond more effectively to client needs.

- Build partnerships: You don’t need to go it alone. Many agencies are finding success by partnering with other companies to expand their offerings. For example, some insurers are partnering with real estate platforms to offer homeowners insurance at the point of sale.

- Focus on operational efficiency: Streamlining your operations can help you move faster. Look for ways to automate repetitive tasks, reduce paperwork, and improve communication across your team. The more efficient your operations, the quicker you can respond to market changes.

2. Innovation: Why Staying Ahead of the Curve is Essential

Innovation is no longer optional in the insurance industry—it’s a necessity. Customers expect personalized, real-time service, and they want products that fit seamlessly into their lives. If you’re not offering these solutions, your competitors will.

Why It Matters:

AI is revolutionizing the insurance industry by making it possible to assess risks more accurately, process claims faster, and offer personalized recommendations to customers. According to Deloitte’s report, AI-related insurance premiums are expected to grow to $4.7 billion globally by 2032, with an annual growth rate of 80%.

What You Can Do:

- Embrace AI and automation: AI can help you deliver faster, more personalized service to your clients. For example, AI-powered chatbots can handle routine inquiries, freeing up your team to focus on more complex customer needs. Meanwhile, automated underwriting systems can speed up the process of issuing policies.

- Offer embedded insurance: Embedded insurance is becoming increasingly popular. This model allows customers to purchase insurance at the same time they’re buying another product, such as a home or car. It’s a seamless experience for the customer and a new revenue stream for your agency. To get started, explore partnerships with businesses in industries like real estate or automotive.

- Develop new products: Innovation isn’t just about technology—it’s also about offering products that meet evolving customer needs. For example, climate change is creating new risks, and there’s growing demand for insurance products that address these challenges. Consider offering coverage options that reward clients for taking preventative measures, like fortifying their homes against natural disasters.

3. Customer-Centricity: Putting Clients at the Center of Your Strategy

Today’s customers expect more than just a standard insurance policy—they want solutions that are tailored to their specific needs. Being customer-centric means designing your products, services, and experiences with the client in mind. By doing so, you can build stronger relationships and improve customer retention.

Why It Matters:

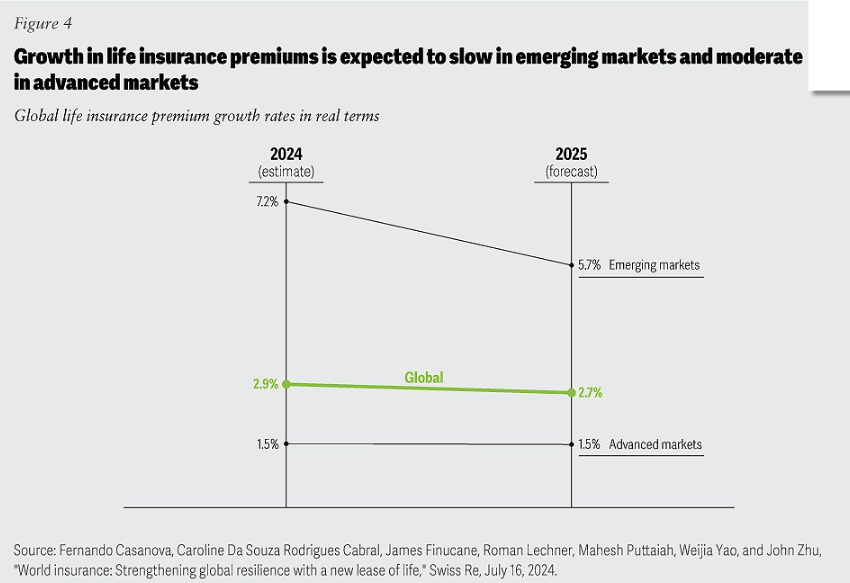

Demand for personalized, customer-centric insurance solutions is on the rise. One example is the growth of the life insurance sector, where younger customers (under 50 years old) are driving demand. These customers are often influenced by social media and expect a seamless digital experience when purchasing insurance.

What You Can Do:

- Leverage data: The more you know about your clients, the better you can serve them. Use data analytics to gain insights into customer behavior and preferences. This can help you personalize your offerings and anticipate client needs before they arise.

- Focus on digital experiences: Many customers prefer to interact with their insurance providers online, whether they’re requesting a quote, filing a claim, or asking a question. Make sure your agency offers a user-friendly digital platform where clients can easily manage their policies.

- Build trust: Trust is the foundation of any customer relationship, especially in the insurance industry. Be transparent about how you use customer data and offer clear explanations of your products and services. Educating your clients on the risks they face and the solutions you provide will help build long-term loyalty.

Climate Change: Turning Risk into Opportunity

One of the biggest challenges facing the insurance industry is climate change. Natural disasters like floods, wildfires, and hurricanes are becoming more frequent, and the financial impact is growing. In 2023, natural catastrophes caused $357 billion in losses worldwide, yet only 35% of those losses were insured.

But while climate change presents significant risks, it also creates new opportunities for insurance agencies that are prepared to meet these challenges.

What You Can Do:

- Close the protection gap: The gap between insured and uninsured losses presents a huge growth opportunity. By offering products that address emerging climate risks, you can help clients protect their assets while expanding your business.

- Reward preventative measures: Encourage your clients to take steps to protect their homes and businesses from climate-related risks. You can offer discounts or incentives for clients who make their properties more resilient, such as by installing storm shutters or reinforcing their roofs.

- Educate clients: Many customers are unaware of the specific risks they face due to climate change. Use your expertise to educate them on how to mitigate these risks and why insurance is a critical part of their risk management strategy.

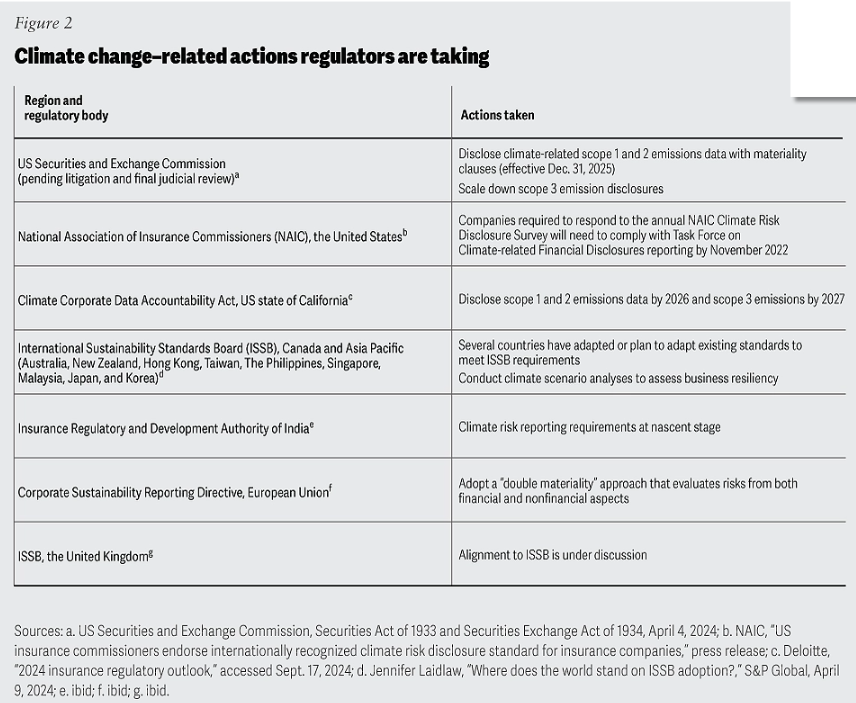

Voluntary disclosures, such as the Task Force on Climate-related Financial Disclosures, the Carbon Disclosure Project, and the Global Reporting Initiative, continue to shape this landscape.24 But recent regulatory updates aim to bolster transparency and investor confidence and provide more robust strategies for assessing progress (figure 2).

Life and Annuity Insurance: Capturing a Growing Market

Interest rates have remained high, which has boosted demand for savings-related insurance products like annuities. In 2023, U.S. annuity sales hit a record $385 billion, and this growth is expected to continue. For life and annuity (L&A) insurers, this presents a significant opportunity.

What You Can Do:

- Target younger customers: Life insurance demand is growing among younger demographics, particularly those under 50. These customers are often influenced by social media and expect a seamless, digital experience when buying insurance. Make sure your agency has a strong online presence and offers easy-to-understand products that appeal to this audience.

- Simplify the buying process: Many people find life insurance complicated and intimidating. By simplifying the process and offering clear, jargon-free explanations, you can attract more customers. Consider offering online tools that allow customers to calculate their coverage needs and get a quote in minutes.

Life premiums are expected to increase 1.5% through 2025 in advanced markets. Strong sales in more emerging markets like China, India, and Latin America could potentially boost premiums by 7.2% and 5.7% in 2024 and 2025, respectively (figure 4).

Conclusion: Seizing the Opportunity for Growth

The insurance industry is facing unprecedented challenges, from climate change to rising customer expectations and the rapid pace of technological advancement. But with these challenges come incredible opportunities for growth.

At InsureBrandSuccess, we believe that independent insurance agencies are well-positioned to thrive in this new landscape. By embracing agility, innovation, and a customer-centric approach, you can not only navigate these changes but also grow your business and deliver even more value to your clients.

As you look ahead to 2025 and beyond, remember that the future of insurance isn’t about simply reacting to risks—it’s about proactively creating solutions that help your clients feel secure and protected, no matter what comes their way.

Credit: Adapted from Deloitte’s “2025 Global Insurance Outlook”