In the fast-paced world of insurance, standing out from the crowd requires a multi-pronged marketing approach. While tried-and-true methods like networking and referrals still hold value, the digital age demands a strong online presence. Here’s where email marketing shines, offering a cost-effective way to nurture leads, engage existing clients, and ultimately drive sales. But managing email campaigns manually can be a time-consuming hassle, especially for busy insurance agents and agencies.

Enter the game-changer: email marketing automation. Let’s explore how these powerful tools can streamline your email marketing efforts, free up your valuable time, and propel your insurance agency to new heights.

The Pain Points: Why Insurance Agencies Need Automation

As an insurance professional, you juggle multiple tasks daily. Client consultations, policy renewals, and quote generation leave little room for crafting personalized email campaigns. Here are some common challenges faced by insurance agencies that automation can effectively address:

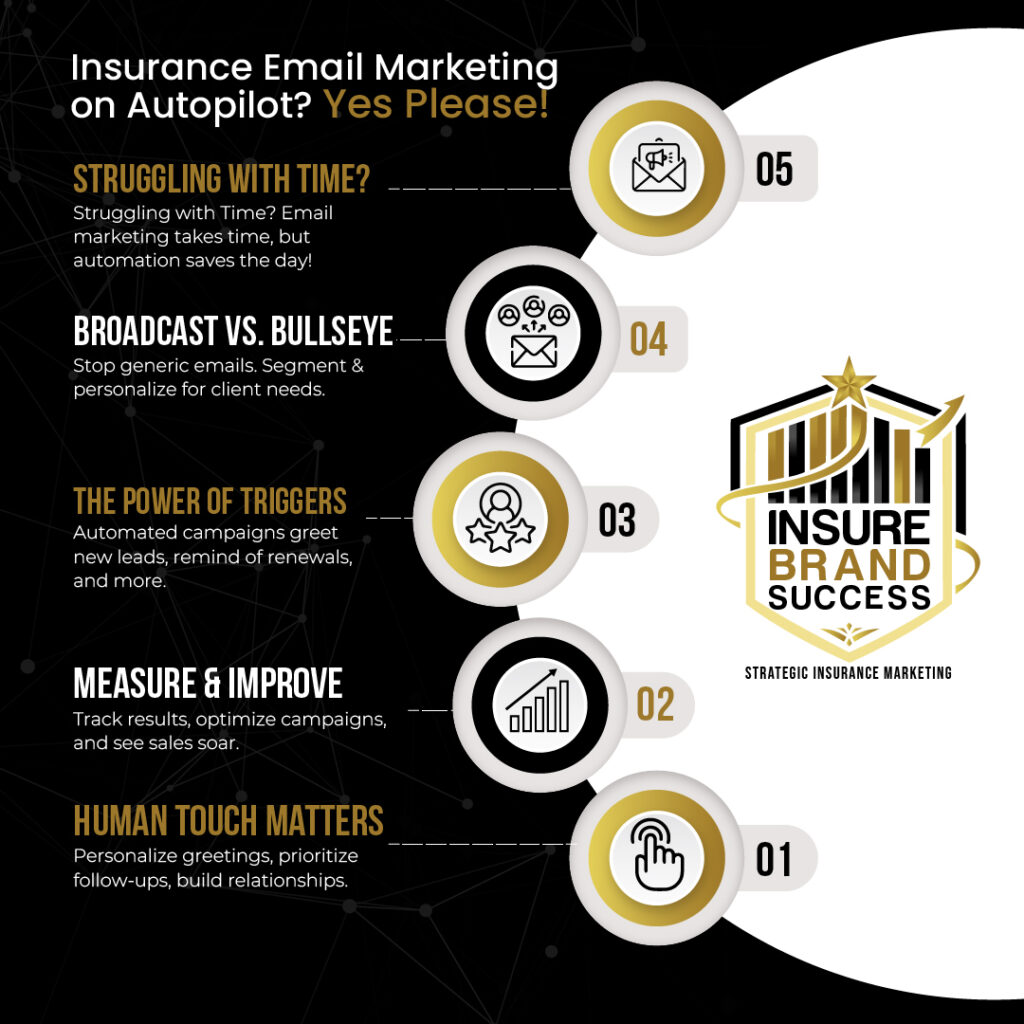

- Time Constraints: Manually creating and sending emails for different segments of your audience is a time-consuming process. Automation eliminates this burden, allowing you to focus on core business activities.

- Inconsistent Communication: Maintaining consistent communication with your audience is crucial for building trust. Automation ensures timely email delivery based on pre-defined triggers, guaranteeing your message reaches the right person at the right time.

- Limited Personalization: Sending generic emails may not resonate with your audience. Automation platforms allow you to personalize emails with customer data, making them more relevant and impactful.

- Campaign Measurement Difficulties: Tracking the success of your email campaigns is essential for optimization. Automation tools provide detailed analytics on open rates, click-through rates, and conversions, helping you refine your strategy.

The Power of Automation: Streamlining Your Insurance Email Marketing

Now that we’ve touched upon the pain points, let’s dive into the magic of automation. Here’s how email marketing automation platforms can streamline your efforts:

- Automated Workflows: Create email drip campaigns triggered by specific events. For example, an automated welcome series greets new subscribers, while policy renewal reminders can be sent near expiration dates.

- Segmentation & Personalization: Divide your audience into targeted segments based on demographics, policy types, or interests. This allows you to send highly relevant emails that resonate with each group.

- Automated A/B Testing: Test different subject lines, email content, and CTAs (calls to action) to see which ones perform better. This data-driven approach helps you optimize your campaigns for maximum impact.

- Enhanced Reporting & Analytics: Gain valuable insights into how your emails are performing. See which emails are getting opened, clicked, and leading to conversions, allowing you to continually refine your strategy.

Popular Email Marketing Automation Platforms for Insurance Agencies

Several top-tier email marketing automation platforms cater to businesses of all sizes. Here’s a look at some popular options, along with their key benefits for insurance agencies:

- Constant Contact: This user-friendly platform offers drag-and-drop email creation tools, pre-designed templates specifically for the insurance industry, and robust segmentation options, making it perfect for beginners.

- Mailchimp: With its user-friendly interface and wide range of integrations, Mailchimp allows you to create visually appealing email campaigns and seamlessly connect with your CRM system for a unified customer view. Their marketing automation features are ideal for nurturing leads and fostering long-term relationships.

- ActiveCampaign: This powerful platform offers advanced automation capabilities, conditional logic, and dynamic content, making it a great choice for agencies looking for a more sophisticated solution. You can create highly customized email journeys that cater to your audience’s specific needs and interests.

- HubSpot: For agencies seeking a comprehensive marketing solution, HubSpot is a strong contender. It offers a suite of marketing tools including email automation, CRM, social media management, and analytics, allowing you to manage all your marketing activities under one roof.

Choosing the Right Platform:

The best platform for your agency will depend on your specific needs, budget, and technical expertise. Consider factors like ease of use, automation features, reporting capabilities, and integrations with your existing CRM or marketing tools. Most platforms offer free trials so you can test-drive their features before making a commitment.

Real-World Examples: How Insurance Agencies Can Leverage Automation

Here are some practical examples of how insurance agencies can leverage email automation to achieve marketing goals:

- Welcome Series: Once a visitor subscribes to your email list, send a series of automated emails that introduce your agency, explain your services, and offer valuable content like “Top 5 FAQs for Homeowners Insurance.”

- Policy Renewal Reminders: Automatically send emails reminding clients about upcoming policy renewals and offer options for easy online renewal.

- Life Event Campaigns: Trigger automated emails based on specific life

- Birthday & Holiday Greetings: Schedule automated birthday or holiday emails to stay top-of-mind with your clients and build stronger relationships.

- Abandoned Cart Recovery: For agencies offering online quotes or policy purchases, implement automated emails that remind potential clients who haven’t completed the process to return and finalize their purchase.

- Educational Drip Campaigns: Create automated drip campaigns that deliver valuable educational content related to specific insurance topics. This establishes your agency as a trusted advisor and positions you as an expert in your field.

Beyond Automation: The Human Touch in Insurance Marketing

While automation is a powerful tool, it’s important to remember that insurance is a relationship-driven business. Don’t let automation replace the human touch. Here’s how to strike the right balance:

- Personalize Greetings & Sign-offs: Always personalize email greetings and sign-offs with your agency’s name and a specific agent’s contact information. This adds a human touch and encourages direct communication.

- Offer Opt-Out Options: Ensure your emails comply with anti-spam regulations by providing clear unsubscribe options.

- Segment for Personalized Offers: Use automation to segment your audience and tailor email content and offers to their specific needs. For example, emails to young drivers might focus on auto insurance options, while those targeting families might highlight life insurance or educational savings plans.

- Follow Up with Leads: While automated campaigns nurture leads, don’t neglect personalized follow-ups. Reach out to leads who haven’t responded to automated emails and offer additional assistance or answer their specific questions.

Conclusion: Streamline, Engage, & Grow with Email Marketing Automation

By embracing email marketing automation, insurance agencies can significantly streamline their marketing efforts, personalize communication with clients, and ultimately drive sales growth. Remember, choose a platform that aligns with your needs and budget, and always prioritize the human touch to build lasting relationships with your audience.

With a well-crafted automation strategy, your insurance agency can stay ahead of the curve in the competitive digital marketplace and attract a steady stream of qualified leads, all while freeing up your valuable time to focus on what matters most – providing exceptional service to your clients.