In the rapidly evolving world of insurance, efficiency, security, and trust are paramount. As the industry faces mounting pressure to improve transparency and streamline operations, a new technology is gaining traction: blockchain. While the term may seem like a buzzword, blockchain has the potential to revolutionize how insurance agencies operate. From speeding up claims processing to enhancing data security, blockchain offers a host of benefits that can transform the way insurance agencies conduct business.

This blog is designed for insurance agents, agency managers, and anyone looking to understand how blockchain can enhance their operations. Let’s dive into the world of blockchain technology and explore its potential to reshape the insurance industry.

From Buzzword to Bonanza: Demystifying Blockchain

At its core, blockchain is a distributed ledger technology that allows data to be securely recorded across a network of computers. Instead of a centralized database, blockchain stores data in “blocks” that are linked in a chain, ensuring that once a record is added, it becomes nearly impossible to alter or delete.

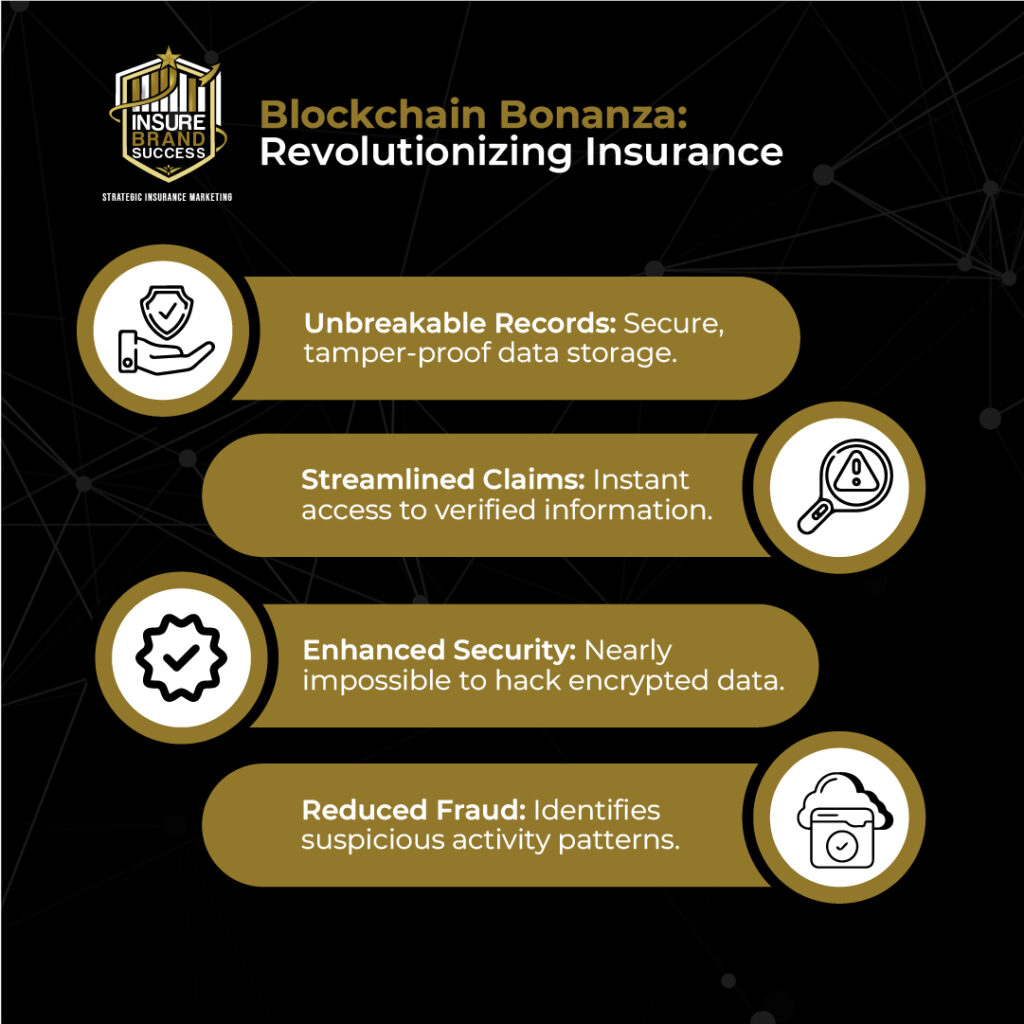

The key features of blockchain make it an exciting prospect for the insurance industry:

- Immutability: Once data is added to the blockchain, it cannot be changed, which enhances trust and transparency—a key consideration in insurance.

- Enhanced Security: Blockchain uses cryptographic encryption, making it highly resistant to hacking or tampering. This level of security is essential for safeguarding sensitive customer data.

- Decentralization: Since blockchain data is stored across multiple nodes (computers), it’s not controlled by a single entity. This prevents data loss or manipulation by any one party.

- Transparency: All participants in the blockchain network can access the ledger, promoting transparency and reducing disputes between insurers and clients.

- Efficiency: Blockchain can automate processes and transactions, potentially reducing administrative overhead and speeding up claims processing.

For an insurance agency, these features translate into increased trust, faster operations, and enhanced security. If you’re looking to boost the efficiency of your insurance agency’s operations, learn more about optimizing your agency’s website with Websites for Insurance Agencies.

Claiming the Blockchain Bounty: Benefits for Insurance

Let’s explore how blockchain can solve some of the most pressing challenges in the insurance industry:

1. Streamlined Claims Processing

One of the most significant pain points in insurance is claims processing, which can be time-consuming and prone to fraud. With blockchain, relevant information such as medical records or accident reports can be securely stored and accessed in real-time. By allowing authorized parties immediate access to verified documents, claims can be processed faster, and the risk of fraud can be reduced.

2. Improved Data Security

Data breaches are a serious concern for insurance agencies. Blockchain’s robust encryption methods make it significantly harder for cybercriminals to access sensitive information. This level of security not only protects your clients but also helps your agency maintain its reputation for trustworthiness.

External resources like IBM’s Guide to Blockchain for Data Security can provide deeper insights into how blockchain technology ensures data integrity and privacy.

3. Enhanced Fraud Detection

Fraudulent claims cost the insurance industry billions each year. Blockchain’s immutable records can help detect inconsistencies and suspicious activity, making it easier to identify potential fraud. By providing a complete, tamper-proof record of transactions, blockchain allows agencies to verify the legitimacy of claims more effectively.

4. Smart Contracts

Blockchain can also facilitate smart contracts, which are self-executing contracts with predefined rules and conditions coded directly into the blockchain. For example, if a client’s flight is delayed, a smart contract could automatically trigger a payout without the need for manual processing. This reduces administrative work and improves customer satisfaction by ensuring timely compensation.

5. Reduced Administrative Costs

By automating various processes and streamlining operations, blockchain can help insurance agencies reduce administrative expenses. Automating claims verification, document storage, and payments can significantly lower operational costs and free up valuable time for your staff.

To stay ahead of the curve and maximize these benefits, learn more about our Insurance SEO Services to ensure your agency stands out as a leader in adopting blockchain technology.

Beyond the Bonanza: Challenges and Considerations

While blockchain offers many exciting opportunities, it’s important to acknowledge some of the current challenges that insurance agencies may face when adopting this technology:

1. Scalability

Blockchain technology, in its current form, can struggle to handle large volumes of data. This scalability issue could pose challenges for insurance agencies processing vast amounts of claims and client information. However, ongoing developments in blockchain technology are working toward overcoming these limitations.

2. Regulation

The regulatory landscape for blockchain is still evolving, and agencies must stay informed about compliance requirements. Governments and regulatory bodies are actively working on creating frameworks to govern blockchain use in industries like insurance. It’s crucial to stay updated on these developments to ensure compliance with local and international laws.

For more insights on blockchain regulation, check out the latest resources from CoinDesk on Blockchain Regulation.

3. Integration Costs

While the long-term benefits of blockchain are promising, integrating blockchain into your existing systems may require a significant upfront investment. Insurance agencies should consider the costs of technology integration, training, and potential system upgrades when exploring blockchain solutions.

Despite these challenges, the potential for blockchain to revolutionize the insurance industry far outweighs the short-term hurdles. Agencies that embrace blockchain now will likely gain a competitive edge in the future.

Getting Started with Blockchain: A Roadmap for Insurance Agencies

Blockchain may seem daunting, but with the right approach, your agency can start small and gradually scale up as you learn more about the technology. Here’s how to get started:

1. Educate Yourself and Your Team

Before diving into blockchain, take the time to educate yourself and your team about the technology. There are numerous online resources, webinars, and courses that can provide a solid understanding of blockchain’s principles and applications in insurance. Platforms like Coursera offer blockchain courses designed for business professionals.

2. Identify Use Cases

Consider how blockchain could specifically address challenges in your agency’s operations. Could it streamline claims processing, enhance data security, or reduce fraud? Start by identifying areas where blockchain’s features—such as transparency or automation—can provide the most value.

3. Research Existing Solutions

Several blockchain platforms are already offering solutions tailored for the insurance industry. Research these platforms to find one that aligns with your agency’s specific needs. Popular platforms like Ethereum and Hyperledger provide blockchain solutions that could fit your agency’s requirements.

4. Pilot Project

Once you’ve identified a use case and a suitable platform, consider starting with a pilot project. Begin by integrating blockchain into a single aspect of your operations, such as claims processing or document verification. Test the system, gather feedback, and make adjustments before scaling up.

Blockchain and Content Marketing: Educating and Engaging Clients

As blockchain technology continues to gain momentum, educating your clients and prospects on its benefits can position your agency as a forward-thinking leader in the insurance industry. Here are a few ways to leverage the excitement around blockchain in your content marketing strategy:

- Blog Posts: Publish informative blog posts about blockchain and its potential to enhance the insurance experience. Focus on how this technology can improve claims processing, reduce fraud, and increase transparency.

- Infographics: Create visually engaging infographics that explain complex blockchain concepts, such as smart contracts or decentralized ledgers, in simple terms. Share these on social media to generate interest and engagement.

- Webinars and Live Q&A Sessions: Host webinars or live Q&A sessions with blockchain experts to discuss the impact of this technology on insurance. This interactive format allows you to connect with clients and prospects directly and answer their questions in real-time.

- Case Studies: Showcase success stories of agencies that have successfully implemented blockchain solutions. Highlight the benefits they’ve experienced, from cost savings to improved efficiency.

For more strategies on how to engage your audience, visit our Insurance Email Marketing service.

The Future is Blockchain

The insurance industry is on the brink of a significant transformation thanks to blockchain technology. As the technology matures, it promises to bring enhanced security, efficiency, and trust to insurance processes. While there are challenges to overcome, forward-thinking agencies that embrace blockchain now will be well-positioned to lead in the future.

By implementing a clear roadmap and leveraging blockchain’s potential, your insurance agency can reduce operational costs, improve client satisfaction, and stay ahead of the competition. Stay informed on the latest developments in blockchain, and don’t hesitate to explore its possibilities for your agency.

Are you ready to embrace the blockchain revolution? Reach out to InsureBrandSuccess.com today and discover how we can help you integrate blockchain into your insurance operations for a more secure and efficient future.

resources: