The Invisible Force Behind Every Thriving Insurance Agency

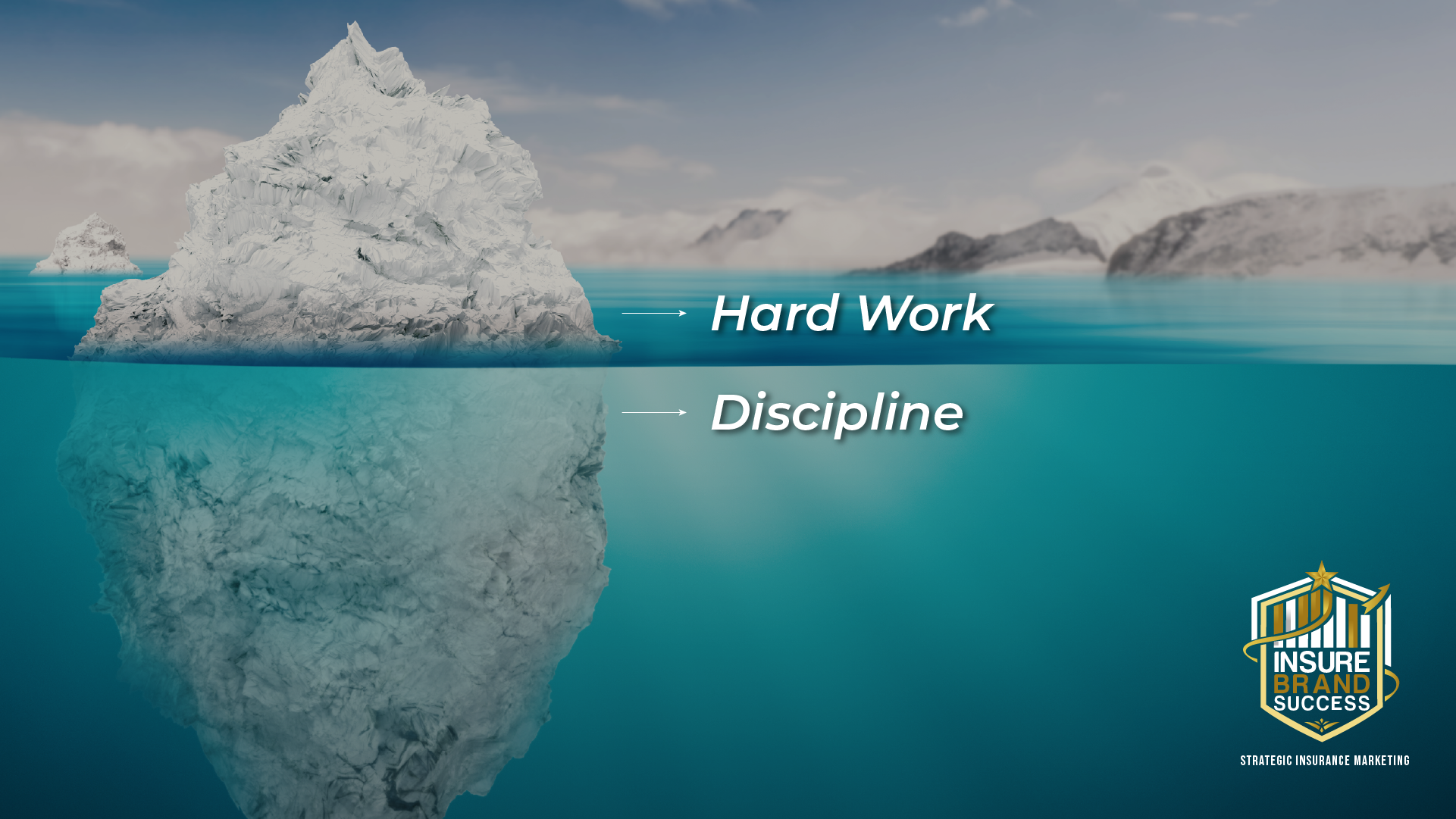

“What if I told you that the difference between a struggling insurance agency and a wildly successful one isn’t luck, better leads, or even more experience? It’s something invisible—yet so powerful—that it quietly determines whether your agency thrives or merely survives.

That force is discipline.”

Not the kind of discipline that feels like a punishment, but the kind that creates unstoppable momentum. The kind that turns one small action into an avalanche of success. The kind that top-performing insurance agency owners live by—while the rest wonder why they can’t seem to break through.

Think about it: Every day, you’re pulled in a thousand directions. New leads to follow up with, existing clients to retain, compliance paperwork that never ends, and a team that depends on you. The pressure is constant. The distractions are endless. And yet… some agency owners seem to glide through these challenges effortlessly, while others drown in the chaos.

So what’s their secret?

It’s not working harder—it’s working smarter by mastering a set of discipline hacks that cost absolutely nothing. No fancy tools. No expensive courses. Just a simple shift in mindset and strategy that will transform the way you run your agency—starting today.

But be warned: Once you see how powerful these hacks are, you’ll never be able to go back to business as usual. Because when discipline stops feeling like a burden and starts feeling like a superpower, everything changes.

Ready to find out what separates the best from the rest? Let’s dive in.

Hack 1: Set Non-Negotiable Daily Priorities – Win the Day Before It Begins

Imagine waking up, grabbing your phone, and diving straight into your emails. A client needs a last-minute policy update. A carrier has sent a notice about new underwriting guidelines. Someone on your team has a “quick” question.

Before you even have your first cup of coffee, you’re already in reaction mode, putting out fires instead of building your business. And just like that, the day runs you—instead of you running the day.

Top-performing insurance agency owners don’t let that happen. They protect their mornings like a fortress. Why? Because the first things you do each day set the tone for everything that follows.

“The secret? Non-negotiable daily priorities.”

Before anything else—before opening your inbox, before taking a single client call—commit to one task that moves your agency forward. Maybe it’s making five high-quality prospecting calls. Maybe it’s following up with a warm lead. Maybe it’s reviewing your agency’s financials for 15 minutes.

These aren’t “if I have time” tasks. They’re musts. They come first—before the chaos of the day tries to steal your focus.

The psychology behind this is simple: small wins create momentum. When you start the day by conquering something that actually grows your business, you step into every other task with more confidence, more clarity, and—most importantly—more control.

So tomorrow morning, before you let your inbox hijack your focus, ask yourself: What’s the one thing I can do today that will make the biggest impact on my agency?

Then do that. Before anything else.

Hack 2: Master the Power of ‘No’ – The Shortcut to Scaling Faster

Let’s be honest—most insurance agency owners are people pleasers by nature. You got into this business to help others, to solve problems, to say yes when clients need you.

But here’s the brutal truth: Every time you say ‘yes’ to something that doesn’t move your agency forward, you’re saying ‘no’ to something that does.

Every unnecessary meeting.

Every unqualified prospect who “just wants a quote.”

Every email that interrupts your workflow.

They don’t just take up time—they steal energy, focus, and opportunity.

“The most successful agency owners ruthlessly protect their time. They say no—a lot. Not because they don’t care, but because they care too much about what actually matters.”

Saying no is a skill, and like any skill, it takes practice. Start small:

- When a client asks for a late-night call that doesn’t serve your schedule, offer your available times instead.

- When an unqualified lead is price shopping, politely direct them to a resource instead of investing an hour in a lost cause.

- When a meeting doesn’t have a clear agenda, decline it or suggest handling it via email.

Your time is your most valuable asset. Every minute spent on low-value tasks is a minute stolen from growing your agency.

So the next time you’re about to say ‘yes’ out of habit, pause and ask yourself: Is this moving my business forward?

If the answer is no, then you know what to do.

Hack 3: Use a Simple System for Tracking Sales and Renewals – Never Let Money Slip Through the Cracks

Imagine this: A loyal client’s policy is up for renewal. You’ve served them well for years. But guess what? They just signed with another agency—one that reached out before you did.

The worst part? You never even realized their policy was expiring.

The truth is, most insurance agents don’t lose clients because of price. They lose them because of silence.

Your best clients are the ones you’ve already earned. Yet, if you don’t have a system in place for tracking renewals, cross-sells, and follow-ups, you’re leaving money on the table every single day.

“The solution? It doesn’t need to be fancy. A spreadsheet, a simple CRM, or even a notebook can transform the way you do business.”

- Track every policy renewal at least 60 days in advance.

- Identify cross-sell opportunities—if they have auto insurance, do they need home coverage too?

- Schedule follow-ups like clockwork so no lead, no renewal, and no referral opportunity slips away.

The most successful insurance agencies aren’t the ones that work the hardest. They’re the ones that work the smartest—and that starts with discipline in tracking the business you’ve already won.

Hack 4: Automate the Mundane (Without Losing the Human Touch)

Let’s be honest—some tasks in your agency drain your time without adding much value. Manually reminding clients about renewals, posting on social media every day, or onboarding a new policyholder the same way, over and over again.

It’s exhausting. And worse? It pulls you away from the high-value activities that actually grow your business.

That’s where automation comes in.

- Email automation can remind clients about renewals weeks in advance—so you’re not scrambling at the last minute.

- Social media scheduling allows you to stay top-of-mind without logging in every day.

- Client onboarding sequences can provide helpful information automatically, making new policyholders feel valued without extra effort.

“But here’s the catch: Automation should never replace human connection.”

A robotic, generic email won’t build trust. A scheduled social media post won’t close deals. Use automation to handle the repetitive work, but always layer in personal engagement—a quick handwritten note, a voice message, or a well-timed phone call—to make your clients feel like they’re more than just another name in your database.

Because in a business built on trust, a little human touch goes a long way.

Hack 5: Follow the 5-Minute Rule for Tough Tasks – Trick Your Brain Into Action

Ever stared at a blank email screen, dreading the first sentence? Or put off making that sales call because you just weren’t “ready”?

Procrastination doesn’t happen because a task is hard. It happens because starting feels overwhelming.

That’s why the 5-Minute Rule works like magic.

Tell yourself: I’ll just do this for 5 minutes.

- Write the first two sentences of that email.

- Dial the number and let it ring just once before hanging up.

- Open the CRM and type in the client’s name to start a follow-up.

Nine times out of ten, once you’ve started, the resistance disappears. Your brain shifts from dreading the task to doing the task.

Before you know it, the email is sent. The call is made. The lead is followed up with.

“Discipline isn’t about having superhuman willpower. It’s about hacking your own psychology—and the easiest way to do that is by lowering the barrier to action.”

So the next time you find yourself avoiding something, don’t commit to finishing it. Just commit to 5 minutes—and watch what happens.

Hack 6: Block Out Deep Work Time for Marketing – Stop Playing Catch-Up

Most insurance agency owners have the same marketing strategy: Whenever they have time.

And that’s exactly why they’re stuck playing catch-up.

- They post on social media when they remember.

- They write a blog when business is slow.

- They send a newsletter when they feel like it.

The result? Inconsistency. And inconsistency is the fastest way to get ignored.

“The most successful agencies don’t market their business when it’s convenient. They schedule it like an unmissable client meeting.”

Here’s how:

- Block out a set time every week for content creation—whether it’s writing an article, recording a video, or engaging on LinkedIn.

- Treat it like a high-priority appointment. If a client wanted to meet, would you cancel? No. So why cancel on growing your own agency?

- Batch your content. Write or record multiple pieces in one session so you’re not scrambling later.

Marketing is not an afterthought. It’s the engine that keeps your business running.

So ask yourself: If I had to schedule my marketing time right now, when would it be?

Then put it in your calendar—because if it’s not scheduled, it’s not real.

Hack 7: Implement a No-Excuses Follow-Up System – The Hidden Million-Dollar Habit

Want to know the difference between a top-performing insurance agent and one who’s constantly chasing new leads but struggling to close?

It’s not sales talent.

It’s not pricing.

It’s not even experience.

It’s follow-up.

The sad reality? Most agents give up after one or two touchpoints. They send an email, maybe leave a voicemail, and if they don’t hear back, they assume, “That lead wasn’t serious.”

“Meanwhile, the agents who dominate the industry? They follow up like clockwork.”

Here’s the golden rule: Three follow-ups across three different channels before moving on.

- Call. Leave a message.

- Send an email with a subject line that gets noticed.

- Follow up with a text or a LinkedIn message.

People are busy—they don’t ignore you because they aren’t interested. They ignore you because life happens. They meant to call back, but their kid got sick, or they got stuck in back-to-back meetings.

Be the agent who stays top of mind. Not in an annoying way—but in a way that shows you care enough to keep showing up.

Follow-up isn’t about nagging—it’s about persistence. And persistence is what separates the agencies that grow year after year from the ones that keep wondering why their leads “aren’t converting.”

Hack 8: Leverage Accountability for Growth – The Success Shortcut Nobody Talks About

Here’s the hard truth: Left to our own devices, we all slack off.

It’s human nature. We get comfortable. We tell ourselves, “I’ll do it tomorrow.” We let distractions creep in.

But when someone else is watching? Everything changes.

- A business coach checking your numbers every week? You show up prepared.

- An accountability partner expecting a report on your lead conversions? You track them religiously.

- A team member relying on you to close a deal? You don’t miss that call.

Because let’s face it—we’ll break promises to ourselves, but we won’t break them to others.

“The most successful insurance agency owners build accountability into their business.”

- They join mastermind groups with other high-level professionals.

- They hire coaches to push them past their comfort zone.

- They hold their teams accountable for clear, measurable KPIs.

If no one is holding you accountable, you’re leaving massive growth on the table. So ask yourself:

“Who do I need to bring into my world to push me to the next level?”

Then take action—because real accountability is the ultimate cheat code for discipline.

Hack 9: Optimize Your Work Environment for Productivity – Stop Letting Chaos Kill Your Focus

Think about the last time you felt truly productive.

You were in the zone. Your brain was sharp. Everything just flowed.

Now think about the opposite—those days when you’re constantly distracted, jumping from task to task, checking your phone, getting sidetracked by emails.

The difference? Your environment.

“Discipline isn’t just about willpower. It’s about removing obstacles so success becomes effortless.”

Start with these simple fixes:

✅ Declutter your desk. A messy workspace = a messy mind. If your physical space is chaotic, your focus will be too.

✅ Turn off notifications. Email pop-ups, phone pings, and Slack messages are hijacking your productivity. Silence them.

✅ Close unnecessary tabs. If your screen looks like a battlefield of open windows, you’re leaking focus. Keep only what you need.

✅ Keep your CRM and inbox organized. If you’re digging through emails and scrambling for client notes, you’re wasting time.

Your work environment should make it easy to stay disciplined—not force you to fight distractions all day.

So take a look around right now—what’s one thing you can fix immediately to create a space that fuels focus instead of killing it?

Hack 10: Stick to a Learning Schedule – The Insurance Agents Who Win Never Stop Growing

The biggest mistake an insurance agency owner can make?

Thinking they already know enough.

The best agents—the ones who consistently grow their business—never stop learning.

- They study new sales techniques.

- They stay on top of policy updates.

- They watch what top competitors are doing—and adapt.

But here’s the problem: Most people don’t “have time” to learn.

“The solution? Make learning part of your routine.”

🚗 Listen to an industry podcast while commuting.

💡 Read one insurance sales tip every morning before checking emails.

📅 Dedicate 30 minutes every Friday to studying a new marketing strategy.

Education isn’t just about knowledge—it’s about staying ahead in an industry that never stops evolving.

The question isn’t whether you have time to learn—it’s whether you’re willing to make time to win.

Hack 11: Create and Stick to a Financial Discipline Routine – Because Revenue Without Control is Just Chaos

Let’s be real—most insurance agency owners don’t get into the business because they love crunching numbers.

But here’s the catch: If you don’t master your finances, your finances will master you.

Ever had a month where commissions were solid, but somehow, your bank account still felt… empty? That’s because revenue isn’t the same as profit. And the fastest way to grow an agency that thrives long-term is to treat financial discipline like a non-negotiable habit.

- Track your expenses weekly. Where is your money actually going? Are you paying for tools you no longer use? Are inefficiencies eating away at your profits?

- Set clear revenue goals. Not just “I want to make more.” Get specific: How many policies need to be written? How much premium needs to be sold?

- Review your numbers every Friday. Don’t wait until tax season to find out if you’re profitable. Know your numbers so you can make smart decisions now.

“The agencies that grow year after year don’t just focus on sales. They focus on smart spending, smart reinvesting, and knowing exactly where their money is working for them.”

You don’t need an accounting degree—you just need discipline.

Hack 12: Develop an “End-of-Day” Reflection Habit – The 10-Minute Ritual That Separates the Good from the Great

Picture this: It’s the end of another long day. Your inbox is still overflowing. There are deals left hanging. Your to-do list feels never-ending.

So, what do you do?

If you’re like most agency owners, you shut your laptop, tell yourself you’ll figure it out tomorrow, and carry that mental clutter into your evening—making it impossible to fully relax.

“But the top performers? They do one simple thing before ending their day: They reflect.”

Just 10 minutes. That’s all it takes.

- What went well today? Celebrate small wins—it builds momentum.

- What still needs attention? Jot it down so your brain doesn’t have to hold onto it overnight.

- What’s the #1 priority for tomorrow? Decide now, so you wake up with clarity instead of chaos.

This habit isn’t just about productivity. It’s about peace of mind. When you close the day with intention, you step into the next one feeling focused, clear, and in control.

And in an industry where the unexpected is always around the corner, that’s an advantage you can’t afford to ignore.

Your Next Move: The Choice That Changes Everything

Every insurance agency owner wants success. More clients. More commissions. More freedom.

But wanting it isn’t enough. Discipline is the bridge between where you are now and where you want to be.

The difference between agencies that grow and those that struggle isn’t luck—it’s daily habits. Small, intentional actions that compound over time.

“Now, you have 12 of the most powerful, cost-free discipline hacks in your hands. The question is:

Will you read them and move on?

Or will you pick just one and start implementing it today?

Success isn’t built in a single day—but the decision to commit to it can be.”

Choose one discipline hack. Apply it now. Watch how it transforms your agency, your focus, and your bottom line.

And if you’re ready for more strategies to help you dominate the insurance industry, make sure you’re subscribed to the InsureBrandSuccess newsletter. The insights you’ll get there? Game-changing.

Because the agents who win aren’t the ones who work harder.

They’re the ones who work smarter.

🚀 Need expert marketing strategies or guidance to grow your agency? Let’s connect!

📩 Contact Nelson Penagos, Marketing & Life Architect – LinkedIn